Oklahoma legislature holds special session Tuesday, local officials share thoughts

/cloudfront-us-east-1.images.arcpublishing.com/gray/7RPPB7TVZRHVLMUGRMY36C3R6Y.bmp)

LAWTON, Okla. (KSWO) - With the Oklahoma legislature starting a special session today, taxes are at the forefront of everyone’s minds.

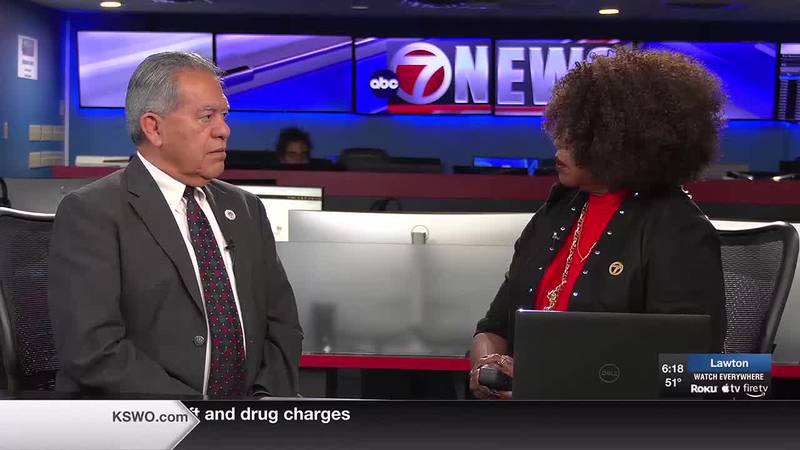

”So, special session, the reason why the governor called us back is about tax policy overall,” said Oklahoma State Representative for House District 62, Daniel Pae. “So there is that component about a tax on Native Americans, there’s also a proposal on cutting the income tax to 0%.”

State Representative Daniel Pae represents West Lawton. He worries a 0% income tax would hurt rural Oklahoma. He says ”If he wants to take us down to 0 that’s about a $4 billion impact on our budget and that’s a pretty significant chunk of our operating budget and so either we have to increase taxes in other areas or we have to cut core services.”

He says there is no winner here. Not changing anything means the meeting was for nothing, but not having an income tax could mean raising taxes in other areas to cover the gap.

Pae’s other concern? Governor Stitt’s policies on tribal relations and taxes.

“And so I disagree with the approach that this governor is taking from the beginning to be more antagonistic and aggressive against the tribes,” Pae explained. “I believe that tribal nations are our partners.”

The taxes affecting Oklahoma tribes are dictated by compacts signed with the state. Kiowa Tribe Chairman Lawrence SpottedBird says he chose not to sign the compact earlier this year, along with 14 other tribal leaders. There are 39 federally recognized tribes in Oklahoma.

”Bully the tribes into becoming a compact agreeing with the state and sharing some of the tax revenue that they assess on their tribal lands and I’m against it,” SpottedBird said. “I don’t think there’s a legal basis for that. Like the state or any local government, we rely on tax revenue to support our government operations and so we should have the ability to assess those taxes on tribal lands without interference.”

Copyright 2023 KSWO. All rights reserved.